For petroleum operations by virtue of Section 13 1 a to j of PPTA for the purpose of ascertaining the adjusted profit of a company in an accounting period deductions shall not be allowed in respect of some disbursements or payments. Those non company car petrol expenses if it is claim by mileage with claim form or like outstation allowance paid per trip is allowable and no perquisite to be required.

As such theres no better time for a refresher course on how to lower your chargeable income.

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Prepaid_Expenses_Recorded_on_the_Income_Statement_Oct_2020-01-5994210f98a84b468a9a113c94643d50.jpg)

. To get the net amount you have to deduct permitted expenses incurred from the gross rental income. Generally an expenditure is not tax deductible if. The list goes as follows.

Following the Budget 2020 announcement in October 2019 the reduced rate. The current CIT rates are provided in the following table. Malaysias tax season is back with businesses preparing to file their income tax returns.

And b steps to determine the amount of entertainment expense allowable as a deduction. Dividends are exempt in the hands of shareholders. 34 Incorporation expenses Income Tax Deduction of Incorporation Expenses Rules 1974 341 For a company incorporated in Malaysia on or after 1 January 1973 with an authorized capital not exceeding RM250000 the following expenses of incorporation are allowed as a deduction against the gross income from its business.

Hence the tax planning tips are. 32019 of Inland Revenue Board of Malaysia. Domestic or private expenses.

A the tax treatment of entertainment expense as a deduction against gross income of a business. Promotional gifts at trade fairs or exhibitions outside Malaysia. Entertainment expenses in summary.

Corporate shareholders receiving exempt single-tier dividends can. Last reviewed - 13 June 2022. The corporate tax rate has decreased from 40 in the late 1980s to the current rate of 24.

Not only has the corporate tax rate been decreased over the years the government has also given SMEs a special rate of 17 on the first RM500000 chargeable income for YA 2019. Staff training for the purpose of obtaining the certificate. Capital expenditure is not allowed as a tax.

CHARTERED TAX INSTITUTE OF MALAYSIA 225750-T e-CTIM No852012 20 June 2012 3 Non- deductible expenditure Paragraph 6 i. Besides the above the Income Tax Act 1967 also specially listed down in Sec 39- deduction not allowed such as. In Budget 2020 to provide additional flexibility to.

The landlord must be a taxpayer with rental income under subsection 4a and subsection 4d Income Tax Act 1967. The expenses must be revenue in nature This means that the expenses are incurred in the normal day-to-day operations of the company. Expenses related to consulting services such as travelling accommodation and food for the purpose of obtaining the certificate.

How To Declare Rental Income In. Corporate - Taxes on corporate income. You can claim tax deduction for expenses that are wholly and exclusively incurred in the production of income.

Chargeable income MYR CIT rate for year of assessment 20212022. Basis of Determining if an Expense is Tax Deductible. Eligible for all taxpayers corporate individual cooperative or other business and non-business entities The rented premises must be used by the tenant for the purpose of carrying out business.

This is provided for in Section 4d of the Income Tax Act 1967. Not wholly and exclusively incurred for the purpose of business eg. Malaysia is under the single-tier tax system.

Hiring disabled worker - Employers are eligible for tax deduction under Public Ruling No. To be allowable under section 331 expenses must fulfill all the following characteristics. Allowable and not-allowable company expenses for tax purposes 3 TEJUTAX Sep 10 2014.

Currently expenses incurred on secretarial and tax filing fees are given a tax deduction of up to RM5000 and RM10000 respectively for each year of assessment YA under the Income Tax Deduction for Expenses in relation to Secretarial Fee and Tax Filing Fee Rules 2014 PU. Companies are not required to deduct tax from dividends paid to shareholders and no tax credits will be available for offset against the recipients tax liability. 19 rows Non-business expenses for example domestic or household.

For example expenditure incurred on samples of company products small souvenirs logo printed bags or travel tickets as gifts to clients in attending company trade exhibition outside Malaysia. Getting A Tax DeductionTax Incentive For Your Company. Relevant Provisions of the Law 21 This PR takes into account laws which are in force as at the date this PR is published.

Individuals who own property in Malaysia and receive a rental income will be subjected to income tax. Private expense Pre-commencement expenditure. Rental Income is calculated using the net amount.

Only full petrol bill paid is subject to tax under perquisite. Yes there is a tax deduction for employers in Malaysia subjected to the terms and conditions set by the LHDN. For both resident and non-resident companies corporate income tax CIT is imposed on income accruing in or derived from Malaysia.

It may still be non-deductible.

Free Bookkeeping Guide Made Easy For Beginners

What Is The Average Company Car Allowance For Sales Reps

13 Business Expenses You Definitely Cannot Deduct

Provision For Income Tax Definition Formula Calculation Examples

How To Estimate Realistic Business Startup Costs 2022 Guide

How The Quebec Investment Expense Deduction Works Manulife Investment Management

Your Complete Guide To Reimbursable Expenses Freshbooks Blog

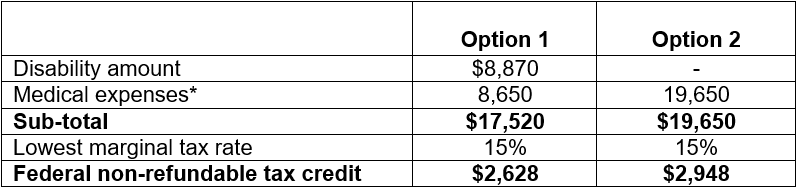

What Are Non Deductible Expenses Rydoo

Five Common Questions To Ask Yourself About Tax Deductible Expenses

Provision For Income Tax Definition Formula Calculation Examples

Expanded Meals And Entertainment Expense Rules Allow For Increased Deductions Our Insights Plante Moran

Taxmatters Ey May 2022 Ey Canada

Getting To Know Gilti A Guide For American Expat Entrepreneurs

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Prepaid_Expenses_Recorded_on_the_Income_Statement_Oct_2020-01-5994210f98a84b468a9a113c94643d50.jpg)

How Are Prepaid Expenses Recorded On The Income Statement

12 Month Rule For Prepaid Expenses Overview Examples

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)